This One Basic KPI Will Tell You If Your Membership Plan Is Making or Losing You Money

I have no clue if we’re actually making money on it.

"Mareaka, we’ve got a bunch of people signed up for our maintenance plan, but I have no clue if we’re actually making money on it."

That’s more common than you think.

A lot of roofing and HVAC companies launch membership or maintenance programs because they sound smart—and they are.

Done right, they smooth out seasonality, create predictable income, and build long-term client loyalty.

But here’s the trap: if you’re only looking at the revenue from those plans—and not the net profit per member—you might be slowly bleeding cash.

Let’s break down how to find out if your membership plan is helping or hurting your bottom line.

Before we dive into it, let me introduce myself if we haven’t met yet.

I’m Mareaka from Bunch Accounting, and I specialize in helping roofing and HVAC business owners like you make confident, profitable decisions.

Most Contractors Don’t Model the Real Cost

It’s easy to launch a plan that “sounds good” at $19.99 or $29.99/month.

But here’s what’s often missed:

Admin time to process and manage memberships

Technician time for scheduled visits (truck rolls)

Parts or materials included in each visit

Discounts or "freebies" promised to members

If you’ve got 150 members at $25/month, that’s $3,750/month in revenue.

But if 100 of those members trigger truck rolls twice a year with $150 in true labor, gas, and admin time each visit, that’s $30,000/year in hard costs.

Now you’re making $45,000/year in revenue… but spending $30,000 just to service it.

Add in parts and the occasional discount, and that plan might be breaking even—or losing money.

The KPI That Actually Tells You the Truth

Forget total revenue or how many members you have.

What really matters is: net profit per member.

That means:

(Total Revenue from Memberships - Total Costs to Service Members) ÷ Total Active Members

If your answer is anything under $0, you’re losing money on every sign-up.

A healthy plan should earn at least $5–$10/month in net profit per member, depending on your model. The higher your margin, the more stable and scalable the plan becomes.

What to Include in Your Cost Structure

Be honest here—this is where the numbers get real:

Admin time: If your office manager spends 10 hours/month chasing down renewals or scheduling tune-ups, that’s real overhead.

Truck rolls: Every visit costs you gas, labor, wear-and-tear, and scheduling capacity.

Parts or materials: Filters, sealants, pipe insulation—if it’s included, it counts.

Free services or discounts: If members get a 10% discount, are you applying that to jobs with tight margins?

Don’t guess. Pull data from the last 3–6 months and average out the true service delivery cost.

Get Your Free Guide

Don’t Forget Churn and Renewal Rates

Here’s what else you should be tracking:

Churn: How many members drop off after 3, 6, or 12 months?

Renewal Rate: Are members sticking around more than one cycle?

Average Ticket: Do members spend more per visit than non-members?

If churn is high and renewals are weak, your plan might be attracting bargain shoppers—not loyal clients. On the flip side, a strong renewal rate with higher average tickets is a sign your plan builds trust and value.

One Small Adjustment Can Flip the Whole Plan

Here’s the good news: sometimes you’re just one tweak away from making your plan profitable.

That could be:

A $3–$5/month price increase

Reducing truck rolls by bundling tune-ups

Switching from "free filters" to a discounted add-on

Optimizing scheduling to reduce idle drive time

We worked with one HVAC business that was losing about $2.25 per member. We adjusted pricing and automated renewal reminders, and they flipped to +$6.40 profit per member within two months.

Ready to Find Out If Yours Is Working?

Memberships can be a great asset—but only if they’re built on real numbers.

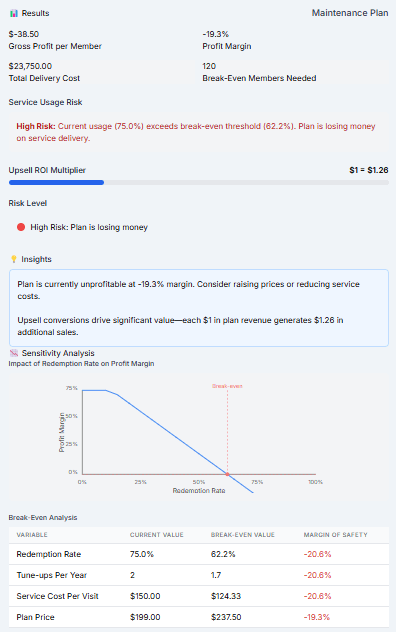

As part of our CFO services, we offer a powerful membership profitability tool that takes the guesswork out of the equation. It breaks down:

Your true cost per visit (labor, truck rolls, parts)

Your redemption rate and how it compares to break-even benchmarks

Your net profit per member so you know exactly where you stand

The margin of safety on things like price, visit frequency, and service cost

It even models how much additional revenue you can generate through upsells—and shows the impact of adjustments like price changes or bundling tune-ups.

With this tool, our clients have gone from losing money per member to hitting +$5–$10 in monthly profit per member within just a few tweaks.

Book a Profit and Tax Analysis Let’s break down your plan, model the true costs, and find your net profit per member so you can scale with confidence (not guesswork).

Let us know what you think in the comments!